philadelphia wage tax return

April 1 2022 in Client News Alerts Tax by Adrienne Straccione. All Philadelphia residents owe the Wage Tax regardless of where they work.

1096 Form Printable Template W2 Forms Template Printable Templates

I had two people ask me this week Do I have to file an income tax return in Philadelphia.

. Upload Employer Submitted Wage Tax Refund Request - Employer Submitted Wage Tax Refund Request. Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the Federal income tax. Income tax returns must be mailed and postmarked by April 18 2022 or dropped off in the New Philadelphia Income Tax Department to be considered on time.

For help getting started or for answers to common questions please see our online tax center guide. Philadelphia School Income Tax Return. From now on use the Philadelphia Tax Center to file and pay the following taxes electronically.

File Philadelphia Wage Tax Return Quarterly in 2022. The first due date to file the Philadelphia Wage Tax return quarterly is May 2 2022. Philadelphia City Income Taxes to Know.

The deadline is weekly monthly semi-monthly or quarterly depending on the amount of Wage Tax. Starting in November 2021 Wage Tax refund requests must be submitted through the Philadelphia Tax Center. City residents have to pay 38712 and non-residents who work in the city owe 35019 2020 tax year.

Personal Information-Residency Information - If the taxpayer was a part-year resident of the Philadelphia School District enter the dates of residency. If you are paid by W-2 confirm that your employer is withholding the City Wage Tax. The City of Brotherly Love will be happy.

These forms help taxpayers file 2021 Wage Tax. The tax still went to Philly. Interest penalties and fees.

If the coupon is printed. Click for 1099 Instructions. If they are you have no filing obligation with the City.

From now on you can complete online returns and payments for this tax on the Philadelphia Tax Center. Generate Extension - Answer YES to generate an SIT extension payment coupon. Non-residents who work in Philadelphia must also pay the Wage Tax.

The tax applies to payments that a person receives from an employer in return for work or services. The City of Philadelphias Department of Revenue has changed the Philadelphia Wage Tax Return filing requirements to quarterly. By tonynova April 22 2016.

For residents and 34481 for non-residents. Tax rate for nonresidents who work in Philadelphia. Ad PA Employee Earnings Tax More Fillable Forms Register and Subscribe Now.

The city is clear in this statement on its web site. PHILADELPHIA WPVI -- So many people are working from home during the pandemic and that could impact your taxes. Amended Return - Answer YES if amending the SIT.

Nonresidents who work in Philadelphia pay a local income tax of 350 which is 043 lower than the local income tax paid by residents. Click for W2 Instructions. Ad Receive you refund via direct deposit.

Make an appointment for City taxes or a water bill in person. Ad PA Employee Earnings Tax More Fillable Forms Register and Subscribe Now. Tax forms instructions.

Non-residents who work in Philadelphia must also pay the Wage Tax. 9 rows Salaried employees can use these forms to apply for a refund on Wage. How to file and pay City taxes.

The nine months of taxes are not really going to New Jersey. Out-of-state employers arent required to withhold this tax thus the employee will need to file the Employee Earnings Tax Return to ensure the tax is paid on their wages earned within the city. The City of Philadelphias Department of Revenue has changed the Philadelphia Wage Tax Return filing requirement to quarterly.

In the state of California the new Wage Tax rate is 38398 percent. This includes all income-based and Covid-EZ non-residents only refunds. Wage Tax refunds.

April 1 2022 in Tax by Adrienne Straccione. The Department of Revenue has provided important reminders regarding the new. NJ is just giving you credit for tax paid twice on the same income.

Electronic funds transfer EFT Modernized e-Filing MeF for City taxes. File a No Tax Liability. Earnings Tax employees Due date.

If you do not file a Wage Refund petition. Electronically file your W-2 forms. BIRT Wage NPT Earnings Liquor SIT Beverage and Tobacco.

If you dont you can claim credit on the NJ return for all your Philadelphia wage tax. All Philadelphia residents owe the City Wage Tax regardless of where they work. The City Wage Tax is a tax on salaries wages commissions and other compensation.

Philadelphia Employee Earnings Tax Return. Also known as the Wage Tax it is typically withheld and remitted by employers with nexus in Philadelphia and employees working for employers who withhold and remit 100 of. Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike.

Pay delinquent tax balances. The Earnings Tax and the Wage Tax refer to the same tax and an employer with nexus in Philadelphia will normally withhold and remit the Philadelphia Wage Tax on its employees. City of Philadelphia Wage Tax This is a tax on salaries wages and other compensation.

For specific deadlines see important dates below. You can also file and pay Wage Tax online. The new rates are as follows.

These are the main income taxes. Ad PA Employee Earnings Tax More Fillable Forms Register and Subscribe Now. The first due date to file the Philadelphia Wage Tax return is May 2 2022.

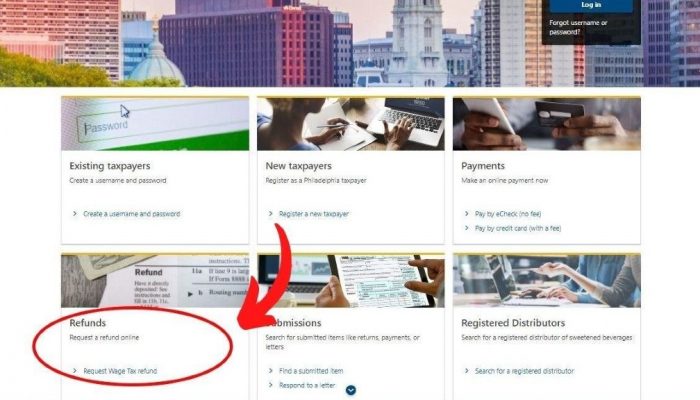

The department is open from 8 am. The Employee Earnings Tax is a tax on salaries wages commissions and other compensation paid to an individual who works or lives in Philadelphia. You dont need a username and password to request a refund on the Philadelphia Tax Center.

The Department of Revenue has provided. Quarterly plus an annual reconciliation. What is the city wage tax in Philadelphia.

Wage Garnishment Md Va Pa Strategic Tax Resolution Wage Garnishment Tax Services Tax Consulting

How To Stop Student Loan Wage Garnishment

11 Tax Sins Not To Commit To Avoid Tax Fraud Charges Tax Relief Center Tax Help Tax Fraud

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

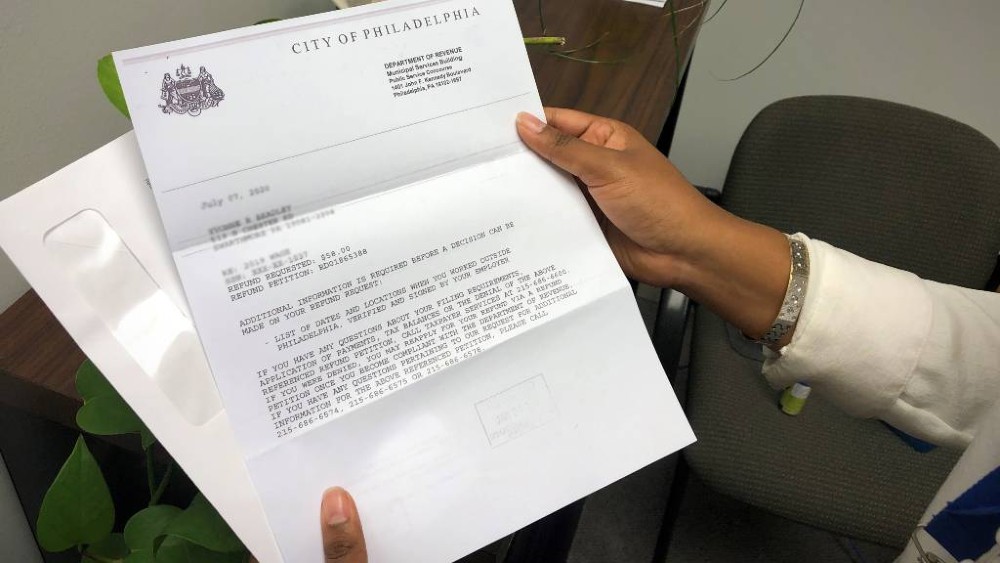

Delayed City Wage Tax Refunds Still Being Paid Nbc10 Philadelphia

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia

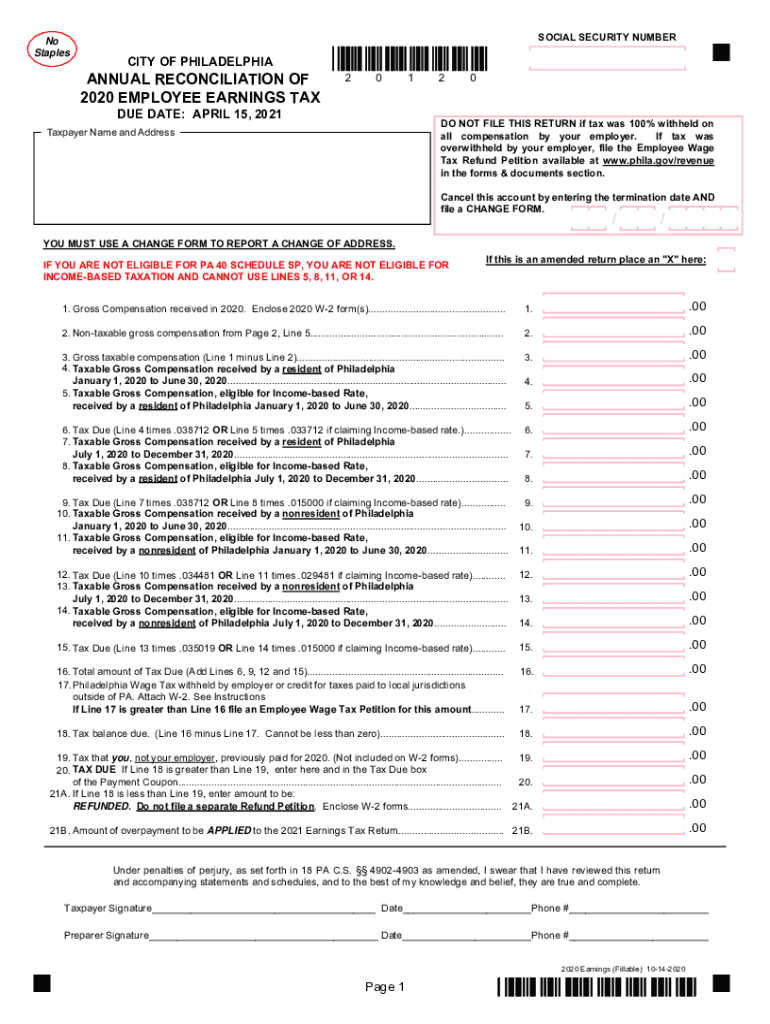

Pa Annual Reconciliation Employee Earnings Tax City Of Philadelphia 2020 2022 Fill Out Tax Template Online Us Legal Forms

Prepare The Annual Reconciliation Of Employer Wage Chegg Com

Philadelphia Wage Tax Refund Program Goes Online To Ease Process

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

Wage Tax Refund Petition 2020 Fill Online Printable Fillable Blank Pdffiller

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

![]()

Philadelphia Wage Tax Refunds Reboot For 2021

How To Use Form 9465 Instructions For Your Irs Payment Plan Irs Payment Plan Tax Payment Plan How To Plan

Wage Garnishment Md Va Pa Strategic Tax Resolution Wage Garnishment Tax Debt Irs Taxes

/cloudfront-us-east-1.images.arcpublishing.com/pmn/JJVOE3MU7BD5XHJ3LOWCOOJTVU.jpg)

Philadelphia Refunds Millions In Wage Taxes To Suburban Commuters

Local Jobs Volunteers Of America Local Jobs Job Volunteer

Wage Garnishment Md Va Pa Strategic Tax Resolution Wage Garnishment Wage Tax Debt